Tech Things: OpenAI Can Never Claim AGI is Here

OpenAI is angling for an IPO. A quick look at how we got here, and where we're going

Two related stories about OpenAI.

First, OpenAI’s conversion to a for-profit and its path to a potential IPO.

One of the things I’ve spent a lot of time documenting on this blog is the saga of OpenAI trying to shake off the non-profit pro-humanity chains that its original founders put on it, in an attempt to make boatloads of money.

Tech Things: OpenAI is an Unaligned Agent

Imagine you were talking to an alien. It's intelligent, able to hold conversations in whatever language you want. It knows how to use a computer. It can create copies of itself. Etc etc. The alien decides it really likes you, and you guys become good friends.

That saga is now approaching its end. OpenAI has been working towards becoming a for profit company, and rumors are swirling that it will IPO within a few years.

The key trick was always that it actually had to, like, become a for profit company. And this was very difficult, because there was a whole lot of legal work that had been done to the effect of “it would be very illegal if OpenAI ever became a for profit and attempts to do so should immediately blow up the company.”

But one of the other things I’ve written about a lot on this blog is that the law, as written, is less important than the law, as implemented. Or, put another way, it turns out that the law is actually just a piece of paper with some ink on it and really what matters is how creatively people choose to interpret that ink. A sufficiently motivated actor can turn every explicit prohibition into a justification.

OpenAI’s path to becoming a for profit ran through the California attorney general. One way to model the average AG is that they are stalwart defenders of the law, people who care a lot about the principles of liberalism and consistency and fairness and justice. Another way to model the average AG is that they are politicians with a law degree. If OpenAI does manage to IPO, it will be a massive windfall for anyone who is standing anywhere close to the blast radius, and will basically instantly mint a new generation of deca-millionaires. It will also be a massive tax windfall, one that would benefit both San Francisco specifically and the entire state generally, and maybe even the entire country. So, perhaps somewhat surprisingly, there actually has been a lot of political pressure to allow OpenAI to become a for profit!

From Politico:

OpenAI and Lehane had left the door open to potentially moving their operations out of California if the restructuring fell through. In what Lehane called a “carrot and bigger carrot” approach, the company also kept up a drumbeat of offering millions in grants to other nonprofits as well as sending economic reports to state officials that outlined the billions in revenue the state would lose if the company packed up. In all, they claimed California would suffer nearly $6 billion in total economic impact in 2030.

From WSJ:

In recent weeks, San Francisco Mayor Daniel Lurie called Bonta to tell him how important it was that OpenAI remain in San Francisco, according to people familiar with the discussion.

The group that doesn’t want OpenAI to become a for profit consists of a few AI safety people, some other non-profits, and Elon Musk. Which you can basically just round off to Elon Musk. Now, that’s not nothing. Elon is a man who is very rich and very vengeful and litigious. But he also seems to hate California and recently moved many of his companies out of California entirely. Meanwhile, on the other hand, you have a lot of the California political apparatus, several other billionaires who keep talking about how much they love California — including Sam Altman, who got Trump to not send the national guard into SF — and a lot of the general populace who wants to get in on the AI gains. What’s an AG to do?

Over the last year and a half, my office has conducted a robust investigation into OpenAI’s initial plan to restructure, followed by its revised plan to recapitalize. This included extensive negotiations with OpenAI, and we secured concessions that ensure charitable assets are used for their intended purpose, safety will be prioritized, as well as a commitment that OpenAI will remain right here in California. With these important concessions in place, we will not be in court opposing OpenAI’s recapitalization plan.

O, that’s what.

As of 3 days ago, OpenAI was allowed to convert into a for profit, clearing the way for its eventual IPO. The specific structure still keeps the non-profit nominally in control, but I think to anyone who’s paying attention, even the fig leaf is just barely hanging on. There are many critiques you could make about this deal — including that it is concerning just how much weight these large corporations are able to throw around in order to get the law to bend to their will — but that will be a different article for a different time.

If OpenAI does go public, what happens to all the OpenAI stock that is currently owned by other public companies, like Oracle and NVIDIA and, of course, Microsoft? They may want to offload some of it, realizing gains on the market. But if OpenAI is really going to be as profitable as Sam needs everyone else to believe, maybe these companies will want to hold onto the stock as a form of future cash flow?

Not Microsoft though. Microsoft, which as a result of this conversion now owns a massive 27% equity stake of OpenAI, will probably want to offload some of that stock.

That brings me to story number two, and the main story for the week — what’s the deal with OpenAI and Microsoft these days?

A few years into OpenAI’s existence, it faced an existential threat. The company didn’t have compute, and as a non-profit, it was never going to get enough money to get compute. In order to avoid that outcome, they partnered with Microsoft. Today, OpenAI is known for making flashy controversial deals in exchange for compute. I even wrote about some of those deals here:

Tech Things: OpenAI's Magic Money

One of the things that you learn when you’re in the startup world for any amount of time is that paper valuations and real valuations are two very different things. For example, imagine I have a company with 1 million shares, and the only thing I have related to that company is a slide deck and a winning smile. Say I sit one of my friend…

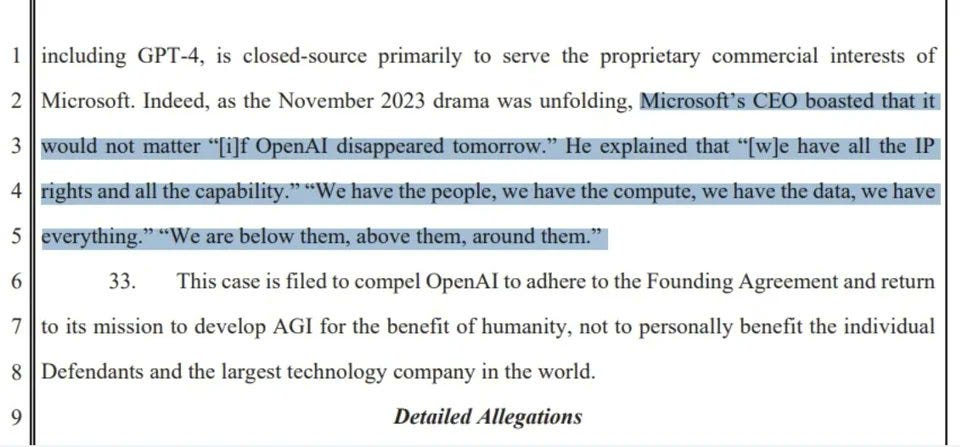

But back in 2018-2019, this was all very new. OpenAI was still, you know, mostly open source and mostly a non-profit. This deal with Microsoft was the first controversial deal, and it was really controversial, in part because it had never happened before. And it had a lot of lasting impacts. You can think of this deal with Microsoft as a sort of original sin that directly or indirectly pushed OpenAI into all of its later drama, including a very messy board fight, like a dozen lawsuits including several with Elon, and the public departures of a lot of employees who went on to create or populate competitors like Anthropic and Thinking Machines and SSI.

The terms of that original Microsoft deal were pretty aggressive. Microsoft walked away with a massive chunk of OpenAI (49% profit share), a commitment that OpenAI would exclusively run on Azure, exclusivity on all OpenAI commercialization, and the right to all of OpenAI’s IP1 until we got to AGI, as determined by OpenAI’s board. In return, Microsoft had to pony up a tiny $1b investment, which it basically immediately ‘recouped’ in Azure bills. In the fullness of time, some of these terms turned out to be less impactful than they first seemed. For example, OpenAI has never turned a profit, so Microsoft hasn’t seen a cent of that original profit share agreement. But some turned out to be way more impactful than anyone considered.

In a vacuum, you may think it dangerous to leave the AGI decision entirely in the hands of your negotiation counter party. Some execs at Microsoft reportedly thought that OpenAI would immediately claim that it had AGI so that it could back out of its research sharing obligations. But that didn’t happen. In fact, the opposite has occurred — these models have gotten better and better and better, but Altman seems to have stepped away from claiming that AGI is around the corner.

If you ask me, the reason for this is rather mundane: it’s about money. The moment Sam gets on stage and announces that AGI is here, the entire AI market collapses. We saw a version of this when GPT5 was released. By all accounts, GPT5 was a great model, one that represented a real step function improvement from GPT4 on release. But as I wrote back in August (blog post, follow-up note):

In retrospect, I think GPT-5 was always going to be disappointing. I’m sympathetic to the OpenAI team here, people were expecting literal miracles. But also, Sam definitely played a role in building up hype — and, as a result, increased the mountain OpenAI would have to eventually summit.

More thoughts on this: one reason why GPT-5 may seem so disappointing is that the big ‘step function’ increases that we got used to in the early days of the AI boom have been diluted across many different players. The earliest version of GPT-4 was released in early 2023. Since then we’ve got:

significantly better multimodal image gen

significantly better code gen, to the point where many people are vibe coding as their day job

significantly better agentic reasoning workflows

significantly larger effective context windows

If you took all of those and packaged it as a single release and called it gpt-5, the delta from gpt-4-as-it-was-on-release and gpt-5 would feel really massive. But because there are other players in the game, OpenAI has to push out features to keep pace, and the step function isn’t actually a step function.

It also does not help that code-gen and agentic reasoning are arguably done better by Anthropic, while long context windows for cheap are done better by Google.

If you look at AI as a whole I think you could make an argument that current models really are a step function up from where they were two years ago. But if you look at OpenAI in specific, it just feels like a weaker sell.

Everyone has been promised God in the machine. Anything less than God is not going to suffice. But also, no one has the same standards for AGI, and there is a hedonistic treadmill effect where incremental improvements get normalized. Which means any announcement of AGI will be met with disappointment, whether rightfully or not. Today, that disappointment would ripple out far beyond just this one company. OpenAI is so wrapped up in the US economy right now that a poorly received declaration of AGI might literally push us into a global recession.

This is, of course, absolutely fantastic for Microsoft. Because of the terms of the original deal, if OpenAI can never claim AGI is here, Microsoft gets to keep its access to all of OpenAI’s research and IP. This has continued even though the relationship between the two companies has obviously soured. Probably the best $1b Microsoft has ever spent!

As part of OpenAI’s conversion to a for-profit, Microsoft and OpenAI renegotiated their previous agreement, and Sam took the opportunity to wriggle out of this doublebind.2 OpenAI is no longer unilaterally responsible for making the AGI call; that responsibility now rests in the hands of an independent “expert panel.” And the research sharing agreement now has a backstop — it ends in 2030 regardless of whether AGI has been achieved.3 OpenAI also got out of its exclusivity contract with Azure. It can now partner with other cloud providers to run workloads.

What did Microsoft get?

An additional commitment for $250b in Azure spend, more of an equity ownership in OpenAI than OpenAI itself,4 IP rights that extend beyond the AGI declaration, and a continuation of a previous entitlement to 20% of all OpenAI revenue.

Everyone is talking about an AI bubble. We have pretty good reason to believe that all of the major labs are hemorrhaging cash. Even though OpenAI is private, we can read between the lines on Microsoft’s public filings to get a sense of where they are. From The Register:

If Microsoft owns 27 percent of OpenAI, it stands to reason under equity accounting that it bears 27 percent of OpenAI’s losses. Microsoft’s admission that it shaved $3.1 billion off its net income to account for its share of OpenAI losses therefore suggests OpenAI lost about $11.5 billion during the quarter. Microsoft declined to comment beyond confirming that the $3.1 billion loss “this year” referred to Microsoft’s current fiscal year, which started July 1, not the calendar year. So that’s a quarterly loss, not a nine-month loss.

In fact, the loss might have been even larger. If you look at page 37 of the SEC filing, it shows that Microsoft’s net loss net of tax was $3.1 billion, but its net loss not including tax was actually $4.1 billion. Moreover, the Wall Street Journal reports that Microsoft’s share of OpenAI during the quarter – before the conversion of OpenAI to a for-profit – was 32.5%, not 27%. If you do the math with those two numbers, you end up with a quarterly loss of more than $12 billion.

It’s unclear where all that money is going. Some folks are questioning whether the unit economics of AI even make sense. Does OpenAI bring in enough revenue on their API and subscription plans to cover the GPU costs of that usage? What about the massive free tier? What about all of the above, plus the amortized cost of training new models? The reason everyone is concerned about an AI bubble is because if any of those questions are answered with a ‘no’ all of the new datacenter buildout is worthless. Actually, it’s worse than worthless — OpenAI is still on the hook for paying for the capex, and turning those datacenters on will simply result in losing even more money. If every customer costs $2 and pays $1, your company’s own growth will kill it!

Cards on the table, I personally do not think the situation is that dire. OpenAI is probably profitable on inference, maybe at around 50% margin.5 And even though they are losing a ton on their free tier, they could easily turn that off. More to the point, regardless of how you feel about OpenAI losing more than it is bringing in, it is bringing in quite a lot — supposedly over 13 billion annually.

Microsoft will continue to get 20% of that. This particular aspect of OpenAI and Microsoft’s relationship was only disclosed (leaked?) last year, and it is not clear when it was inked. OpenAI has since been agitating to bring the revenue share percentage down, aiming for 8%. Clearly they did not win that fight.

First, this is pretty bad for OpenAI. They are already in the red; losing 20% on top of everything else just pushes them even deeper. Second, Microsoft remains very well hedged against a possible bubble pop. If AI is actually worth all the money in the world, Microsoft has a 27% stake in that. And if AI is a sham, Microsoft will still get its money out and then some while the gravy train is rolling.

Net net, this news makes me even more bearish on the short term state of AI and the incoming AI bubble pop. Microsoft knows more about what OpenAI is up to than any other company; what does it say that they fought to keep the ‘pull the money out’ provision in their negotiation? I think it’s somewhat positive that OpenAI thinks they can survive even with a continuation of an effective 20% tax hike. But OpenAI is also very willing to burn other people’s money, that’s basically their entire business model, so what’s an additional 20% here or there?

Either way, one thing is very clear. Satya Nadella will go down in history for his masterclass handling of every part of the OpenAI story.

There are some specifics here — Microsoft got access to research but technically not model weights directly — but this is splitting hairs.

Some people may argue that having a third party evaluate AGI is actually a concession to Microsoft instead of a concession to OpenAI. Personally, I think this just reflects how strong Microsoft’s negotiating position is — they seem to win either way.

Technically the 2030 date is just for research, while models and products go until 2032 independent of any claims of AGI

The non-profit only got 26%! Microsoft has 27!