Tech Things: Tesla, Waymo, and Self Driving Cars

Tesla gets rocked in earnings. Waymo keeps on keeping on.

Tesla

I wasn't planning to write another "Tech Things" article so quickly. Normally I cycle through a few different blog threads. I hadn't written about Civ 7 in a while. It's fun playing Civ 7, I should do that more instead of thinking about the federal government or whatever.

But then the Tesla earnings call happened. And I mean, wow. How could I not write about this?

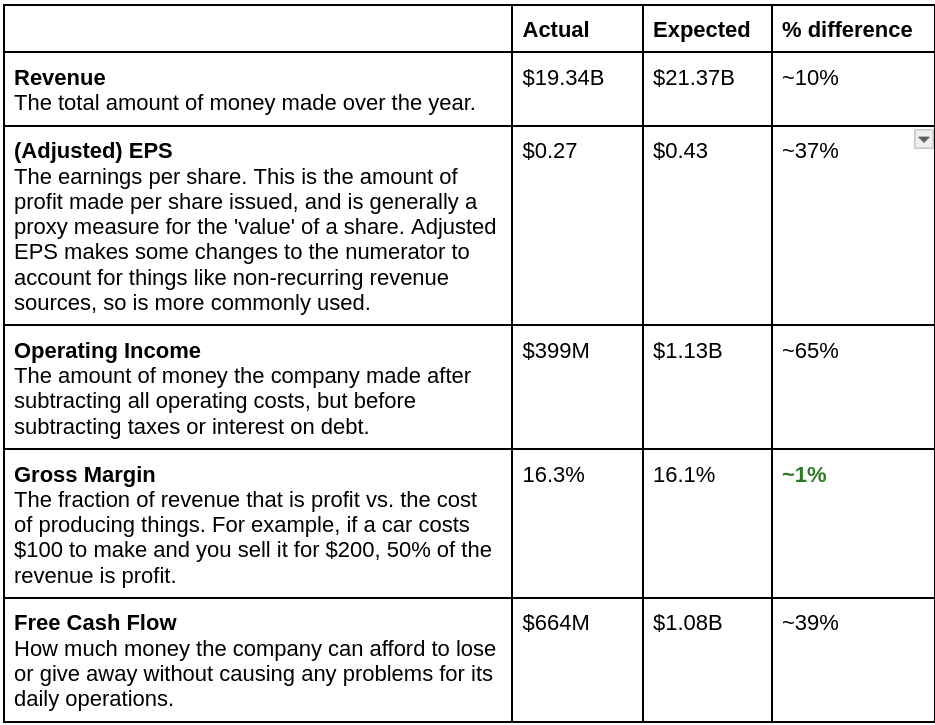

I don't natively speak finance so I had to have a friend of mine translate for me. We basically landed on the following table:

I mark out Gross Margin in green because it's the only thing that is actually positive in this earnings call, everything else would be blood red if I colored it.

I'm no financial expert, but I'd say this is…not good? To have a 65% decrease on operating income over a single quarter is pretty wild. Note that this is, somehow, still understating the damage. Tesla owns a lot of bitcoin, for some reason. In their Q4 earnings, they reported a $600M increase in the bitcoin price as part of their earnings. BTC is obviously extremely volatile, and it has gone up nearly 10% in the last 5 days for…reasons. But that is still below its value at the end of Q4, and that loss was not accounted for in Tesla's earning call today.

This is also, in some sense, the least surprising earnings call ever, in the history of earnings calls. Who could have seen this coming? Well, for one, Elon Musk!

Of course. Of course. The man spent a full 6 months alienating his consumer base so completely that Tesla graffiti is now a top priority of the DOJ. You know who buys a lot of EVs? Coastal elite liberals! Canadians and Europeans! People who care about the environment! And now all of my Canadian European environmentalist coastal elite friends who have Teslas are embarrassed and come up with excuses for why they own one! Look, I'm not running several mutli-billion dollar companies, so take my advice with a grain of salt. But, like, if I were the CEO of a big public company, I would probably try to avoid calling my customers losers who hate their country? You can take that nugget of wisdom for free folks.

I don't want to make assumptions about Elon's motives, except to say that it seems like the man is basically "post-money". It shouldn't be surprising that he's ok with losing money in general. He has so much of it that the marginal dollar is probably like the marginal drop of water in his very expensive bathtub.1 Spending a few billions on the most political power in the world besides the actual president seems like a decent trade for him.

Still, assuming that he does actually care about how Tesla's stock is doing, it seems like he's been engaging in a massive own goal.

I've written extensively on moats in the past:

Companies live and die based on their ability to carve out unique niches for themselves. The starting goal of every company is to become a monopoly in some small part of a massive market. Once the company is indispensable in one small area, the company is free to expand while always maintaining a foothold. The initial monopoly point can be incredibly small -- maybe the market is only 100 people -- but as long as the company is a monopoly in that space, it can thrive.

A monopoly is defined by moats -- namely, the parts of your product or business model that prevent others from stealing your thunder. I tend to think of moats as ‘reasons people will use my product, even if someone else copies everything about it that is public’. Every startup needs to think at least a bit about what their moats are, how they can be strengthened, and how to build new ones. Once your moats are in place, you have a defensible position from which you can expand outward to exert influence and grow revenue.

In the digital world, there are a lot of great moat-like opportunities that are available. You can create a moat out of the inherent stickiness of user data, like Dropbox. You can create a moat out of network effects, like Meta or Netflix. You can create a moat out of infrastructure, like Amazon.

In the real world, there are far fewer opportunities for moats. There's no equivalent for like, social media network effects. What would that even mean for a car? The main type of moat in the physical world is the brand moat:

Brands can feel ephemeral because they take so many forms. A brand can be expressed in social media posts and billboards, in your product features and your logo, in your website copy and the way you greet your customers. But the core essence of a brand is the social trust that you build up with your customers. It is a promise or a set of promises that your customers come to expect about your product and your company. And everything about your company derives from that promise.

A brand moat, then, is the social trust that you have built up with your audience, that your competitors will have to overcome to compete with you.

Funny enough, the vast majority of things in the world are sold on the back of brand moats. Apple is the world's most valuable company because their brand is 'sleek and cool' and everyone who's anyone wants to get the latest Apple shit so they too can be 'sleek and cool'. Branding is the backbone of fashion (see: LVMH or Nike) and food (Coke vs Pepsi) and movie studios (Pixar is famously 'diluting' their brand). Brand moats are the reason Disney and Nintendo are so litigious about how their IP gets used! Both companies depend on being known for their family friendly content, so both companies would rather sue everyone else into oblivion than let that brand slip for even a moment. TJs vs Wegmans, Lays vs Doritos, Ferrari vs Tesla. Brand brand brand.

When you go to McDonald's, you know what you're in for. Why? Because of the brand moat. It's not like McD's is doing anything special. Anyone can make a burger. Lots of people can make a better burger than the folks over at McD's. To put it in VC terms, McDonald's has no "technical moat". Doesn't matter, though, because no one is going to give your burger a passing thought. You don't have the brand.

In my opinion, Tesla's only moat is the brand moat. They are a car company! Even if they had some crazy innovation that was the magic unlock for EVs, it's not like that was going to be a secret forever! Once there was an obvious market appetite for EVs, every other car company in the world was going to start manufacturing them. And they were going to do so at every possible price range. Now, Tesla was absolutely the first-mover in EVs, and in that position it was able to consolidate a lot of good will, brand recognition, and even standards-setting in the most valuable consumer market in the world. That was the foundation for an extremely strong brand moat…but then Elon basically blew it all up (paved it over?) in two fiscal quarters. And without a moat, Tesla is just another EV in a very red ocean of EVs.

If I was Tesla, the real concern I would have is the increasing market share of Chinese competitor BYD. Unlike some of the other players in this space, BYD is about as vertically integrated as Tesla is. They make their own batteries and own their own factories and even do their own AI training. The main difference is that they are significantly cheaper at every level — you can get a BYD EV for under $10k, while the cheapest Tesla is $40k. (!!!) With that kind of a price difference, Tesla would have a tough time in the EU market regardless of Elon's personal political toxicity. The average monthly salary in the US is roughly $4500. Meanwhile, the average monthly salary in Germany is $3600, and the average in France is $2900. And Germany and France are on the richer end of the European markets! Assuming that half the salary goes to cost of living, do you think that the average Eastern European on a $1k monthly salary is going to wait 7 years to buy a Tesla?

I can already hear the naysayers and fanboys. Tesla can continue pushing the envelope of technical innovation! Tesla isn’t just an EV company, they are also a robotaxi company! Tesla has a data moat in the form of the road-miles they have driven and recorded for their Tesla Autopilot!

Yea, like, maybe. But if you ask me, it is not at all clear that Tesla has a viable path forward there either, especially when stacked up against its primary competitor in the space.

Waymo

To be honest, I was looking for an excuse to write about self driving cars. The Tech Things column initially started as a general-purpose update on things happening in the tech space, a bit like Matt Levine's Money Stuff. Now, Matt has a lot more patience than I do, and also writes as a full time job, so he's able to output a lot more content. I'm lucky if I average one of these 'Tech Things' posts every couple of weeks. And that in turn means I only ever end up covering big stuff that's happening in AI — mostly because that's where all the big stuff is happening overall, and also because I'm naturally biased towards that space as my area of expertise.2 I feel like unfortunately nothing really has happened in the self driving car market for a bit. But Tesla is like kinda related to self driving cars, so this is a great launch pad for me to write about the things I wanted to write about anyway.3

Tesla claims that it will have a fleet of robotaxis, and will have full self-driving, and so on. The problem is, we can see exactly what it would take to do all that because Waymo is a comp that is on the roads already. And if you look for more than 5 minutes, it's obvious that Tesla is wayyyy behind.

Waymos are, objectively, amazing. And if you haven't had a chance to try one yet, get on a flight to SF and get in one. It's a magical experience, one that I enjoy every time I'm in the Bay.

But in keeping with the more finance oriented theme of this post, the real story behind Waymo is the insurance story.

Today, we’re sharing our new cutting-edge research with Swiss Re, one of the world’s leading reinsurers, analyzing liability claims related to collisions from 25.3 million fully autonomous miles driven by Waymo. The study uses auto liability claims aggregate statistics as a proxy for at-fault collisions and expands on our previous research. It demonstrates that as we've scaled operations across Phoenix, San Francisco, Los Angeles, and Austin, the Waymo Driver significantly outperforms both the overall driving population and the latest generation of human-driven vehicles equipped with advanced driver assistance systems (ADAS).

The study compared Waymo’s liability claims to human driver baselines, which are based on Swiss Re’s data from over 500,000 claims and over 200 billion miles of exposure. It found that the Waymo Driver demonstrated better safety performance when compared to human-driven vehicles, with an 88% reduction in property damage claims and 92% reduction in bodily injury claims. In real numbers, across 25.3 million miles, the Waymo Driver was involved in just nine property damage claims and two bodily injury claims. Both bodily injury claims are still open and described in the paper. For the same distance, human drivers would be expected to have 78 property damage and 26 bodily injury claims.

Swiss Re is no joke. These guys are one of the world's largest insurers. They insured the World Trade Center. Their entire job is to price risk. So if they are coming out and saying that Waymo is safer than human drivers, they mean it.

Engadget is a bit less subtle.

Though the specifics of Waymo's insurance set up is private, I have heard that Waymo has a fantastic deal on their insurance, that dollar-per-mile they pay something like 60% less than a human driver would.4 That may not sound like much to the untrained ear, but to me that is the most ringing endorsement that you could possibly have. Waymo has quietly won the self-driving car race, all that stands in their way is regulation and manufacturing.

By the way, Waymo is forced to report all crashes regardless of fault. That means you can just, like, go read all of the crash reports that have ever occurred with a Waymo. I recommend reading this great post that did just that. Apparently, most Waymo crashes involve other people running into it. Again, that tracks with my experience. It is not hard to imagine a future where insurers have a published rate that is only for people who own Waymos, and anyone who wants to get a 'human driven' vehicle has to pay a substantial premium.

You may think I'm exaggerating, but Waymo has fully earned this.

I first rode in a Waymo in 2016, back when it was still a Google X project called Chauffeur. Even back then the cars could more or less drive on the roads without any human involvement. But Google waited an extra 6 years before they decided to really put their cars on the street, first in Arizona and later in SF. Chauffeur itself got started all the way back in 2009. They’ve been working on this problem for 16 years.

From the beginning, Google understood that their cars could not just be at parity with human drivers, but rather had to be 100x better. When an individual Uber driver is a shitty driver, and gets into a bunch of accidents, we just blame that particular driver. Sure, there may be some grumbling about how Uber has to do a better job of vetting drivers, but I think everyone more or less understands that Uber is primarily connecting independent-ish drivers and riders, and when you get into an Uber you're taking some amount of the risk. But for a robotaxi service like Waymo, any mistake across the entire fleet is on the company. There is no driver to blame!

So Google went really slow. And they spent a lot of time investing in giving their cars superpowers that would make them better than human drivers. The lidars are the most prominent example — back in 2015, each lidar was a whopping $75,000 per unit. The cost has since shrunk considerably, to under $200 per unit, but it was considered a huge bet at the time. On top of that, Google built out a Google-maps-style database that all of its cars constantly read and write to. That database stores details about roads, of course. But it also tracks things like stop signs, traffic lights, cones, and more. This all provides an extra layer of redundancy and memory to the overall fleet.

The end result is a product that meets even the most stringent standards for safety. Self driving is simply a reality for the hundreds of thousands of people that live in SF, LA, Phoenix, or any of the other places Waymo operates. And as time goes on, and Waymo racks up more miles, the case to regulators will become easier and easier. After all, it is hard to say no to "we save lives and your constituents will get to experience joyous wonder".

All that's left is providing supply to meet demand.

On this, Waymo actually does seem to be struggling a bit. Even though Waymo has completed millions and millions of miles over hundreds of thousands of rides, they are operating fewer than 1000 cars nation wide.

In SF, the cost of a Waymo is artificially somewhere around 2-3x the cost of an Uber or Lyft. It's possible that having an actual third competitor in the city forces the latter two human rideshare companies to lower prices. But I think in reality there simply are not enough Waymo cars to go around yet. If Waymo lowered prices to match Uber and Lyft, the Waymo wait times — which are already high — would skyrocket. So instead of having a worse user experience, Waymo is capturing additional revenue while getting the rest of its fleet together.

This is, like, a fantastic problem to have. That Waymo can charge 2-3x their competitors and still be fully booked, even though there are hundreds of vehicles crawling around the SF, shows how much they have built a strictly superior product. Now, even as Waymo has slowly increased the number of cars in SF, it has yet to expand to the rest of South Bay (except for a few areas around Mountain View and Palo Alto).5 It makes sense to focus on SF just from an economics perspective; areas with high density presumably get more bang for their buck. Still, that also means that Waymo has not yet hit capacity in SF, and they simply need more cars.

It's not clear to me where the bottleneck is; there could be many.

Waymo requires a factory sized warehouse on the outskirts of the city; the cars go there when they are low on battery or have some sort of malfunction. That space is staffed like an airport — there are tons of people buzzing about managing the fleet. So there's some amount of capital expenditure required for Waymo to set up in a new area, even beyond the cost of the cars themselves.

Or maybe the primary issue is simply mapping. Waymo has to first get regulatory approval to actually map an area out, which is presumably something of an annoying and time consuming task to do well. Once completed, Waymo would have to go back and get a second round of approvals. Again, these approvals should get easier over time, but I could see Waymo having to prove itself over and over for each new map it wants to create.

Either way, right now it's Waymo's game. I mean that literally: there are no other robotaxis on the road, anywhere. Waymo's biggest competitor, Cruise, basically got shut down for safety reasons after one of its cars decided to sit on top of a person for an hour. Not exactly a great branding moment.6 In general, all of Waymo's competitors have had a tough time with safety concerns, because they are all demonstrably less safe. I'm sure at some point someone else will be able to come through the woodwork, especially as the technology becomes a bit easier to develop. But Waymo's track record is a moat in itself — they set the bar for safety, and it is extremely high.

Back to Tesla

Many people I knew at Waymo were privately furious that Tesla branded their driver assist features as "Tesla Autopilot". Part of that fury was because people would just get hurt and die due to negligence because the marketing didn’t match the reality of what Tesla’s system could do — and that has happened several times. But the bigger concern was that Tesla would ruin the game for everyone else. There was a serious risk that accidents caused by "Autopilot" would chill the entire rest of the industry; if there was a really bad crash, vocal public opposition could have stopped any self-driving cars at all. In 2025 Waymo seems to have mostly dodged that bullet, pulling away from competitors and establishing a brand for itself as “the safe one” that is developing things the right way.

By contrast, Tesla's Autopilot is…unsafe. Everyone I know who owns a Tesla says it's unsafe. It doesn't handle turns right, it goes way too fast at the wrong places, it sometimes will make obvious visual mistakes. It's simply not an autopilot system. You may be lulled into a sense of security by how well it handles 95% of roads, but that's just not a high enough percentage for you to actually be safe while driving a 2 ton vehicle at high speed

Unfortunately for Tesla, most of the flaws of its autopilot system are directly because of decisions made by Elon. The lidar one is the obvious misstep — Elon forced the company to scrap any plans to use lidar, arguing that Tesla should be able to do full self-driving with cameras alone. Generously, this may have made some amount of sense at the time. Lidars were expensive, and Elon was trying to sell cars. A lidar on each car would have massively jacked up the price. But Elon of all people should have known that the lidar price would go down, especially if there were multiple market buyers. And any continued refusal to use lidar in 2025 just feels totally silly.

The only other justification I can come up with is that Elon has not internalized the lesson Waymo understood from the beginning about the importance of car safety. Elon maybe thinks Tesla only needs to be 2-5 better than the average driver. If that's the case, he is going to be sorely disappointed by regulators’ appetite to approve Tesla robotaxis in their current state. Especially, again, since Waymo has proven that it can all be done to a much higher safety standard.

Also, like, regulators aren't stupid. They know that Elon has a tenuous relationship to safety. They see it in the way he talks, acts, and tweets. Every time the man is like "we will have full self driving tomorrow" every regulator on the planet thinks about his ketamine usage and rolls their eyes. Also, like, I can't imagine that Elon has made a lot of friends with his actions at DOGE. Another piece of advice: if your public company depends on the largesse of state bureaucrats, don't threaten their jobs with a chainsaw?

And I personally heard some stories about Elon's approach to managing the self-driving car org within Tesla that make me generally skeptical of trusting my life to a Tesla car. Elon is notoriously a pain to work with, refusing to listen to other people when they say that something is difficult or can't be done. Apparently Autopilot is massively overtrained on Elon's route to the office, because every time the Autopilot team tried to do things the right way the system wouldn't be perfect on Elon's route to the office and he would barge in and complain about it until they promised to fix it. But that of course means Autopilot is worse everywhere else! This fits into the general pattern of Elon's employees having to work around him instead of with him.

Anyway, the reason I am spending so much time talking about Tesla's self-driving car efforts is because Elon ruined Tesla's brand moat, so their best avenue forward is to continue innovating on legitimately novel technology. Given how they are positioned, the most obvious thing for them to go for is full-self-driving. I think Elon maybe knows this, which is why he is promising robotaxis in Austin in June. But in typical Elon fashion, he makes some pretty bold claims, like "I predict there will be millions of Teslas operating autonomously — fully autonomously — in the second half of next year". Cards on the table, I would be shocked if that came true. In my personal opinion, Tesla's self-driving capability today is behind where Waymo was in 2016. And while Elon is promising some sort of big update to make the cars better, I’m skeptical that that update will be so good, they will be able to go from where they are today to fully independent cars in a month or two.

I will say this: if Tesla DOES manage to match Waymo's self-driving ability using only the cars they currently have on the road, they will actually manage to scale relatively fast. Tesla in some ways has the opposite problem that Waymo does. Waymo is capped on supply, they can't get enough cars on the road fast enough. Tesla on the other hand already has the cars on the road! They are capped on software, they can't figure out how to actually do this self driving thing right. What remains to be seen is whether it is even possible to get Waymo-level self-driving without lidar. If it turns out that it is literally impossible to get to full self driving without lidar — or indeed, without other sensors besides cameras — Tesla is well and truly screwed. Any supposed advantage that they may have by having all those cars on the road already is just gone. Worse, all of those miles that they have already collected would also be a lot less useful, since that data would not have the full sensor array.7

The market seems to be less skeptical than I am. Even though Tesla got slaughtered in their earnings, the stock is trading up almost 5%, and it has gone up even more after hours, and is still trading high as of this morning. Tesla has always had a large retail investor base. As a result, its stock price has rarely correlated with…well, anything. But if I had to guess, retail investors are less willing or able to parse the financial-ese that I opened with, and are instead getting hyped up about robotaxis and Optimus robots.8 Or maybe they are just excited that Elon seems to be leaving DOGE and coming back to Tesla. Or maybe they think that Elon’s political power will save the company, and Trump will issue an EO mandating that everyone buy a Tesla immediately at risk of going to an El Salvadoran jail. It's hard to say.

The reality is that Tesla has never traded like a car company. It's always been seen as a tech stock, even though it does not have the extremely favorable margins that make digital sales so lucrative. All tech stocks are hype machines in some form or another, so as long as Elon can continue to sprinkle the promise of future sci-fi magic, Tesla will do fine. The question is whether Elon's personal brand has been so damaged that all the sci-fi magic has turned to ash and dust. I sold all of the Tesla that I was holding the moment Elon entered the political sphere. Now that he’s trying to jump back out, he may discover that sometimes when you move fast and break things you cannot fix them.

Maybe this is actually a fully general argument against rich CEOs. Boardrooms should take note: if your CEO gets too rich they may actually stop caring about money.

And so as a result I have to spend less time fact checking and can spend more time just flinging my opinions out into the ether.

And I get to make fun of Tesla to boot, it's like Christmas.

Note: I couldn't corroborate that outside my original source. Still, I more or less believe it just having ridden in their cars.

So that Sergey can consistently get a ride home, one suspects.

Ironically, having the Cruise stay on top of the individual was probably the right decision. It would have done more damage to the woman in question if the car had tried to drive off her. But the optics were pretty terrible for the company.

This is partially why I assume Musk is hesitant to add lidars on now. They would effectively be starting from scratch on their training data collection.

I didn't spend much time on the Optimus stuff, but Elon's claims about what he aims to accomplish here — thousands of Optimus bots working in factories by EoY — feel outlandish as well.